If you’re new to investing and looking for a safe, stable place to grow your money, you’ve probably heard of Treasury Direct. It’s one of the most beginner-friendly ways to invest, backed by the government and accessible online.

In this article, we’ll explain exactly what Treasury Direct is, how it works, and why so many people consider it one of the safest investment options available.

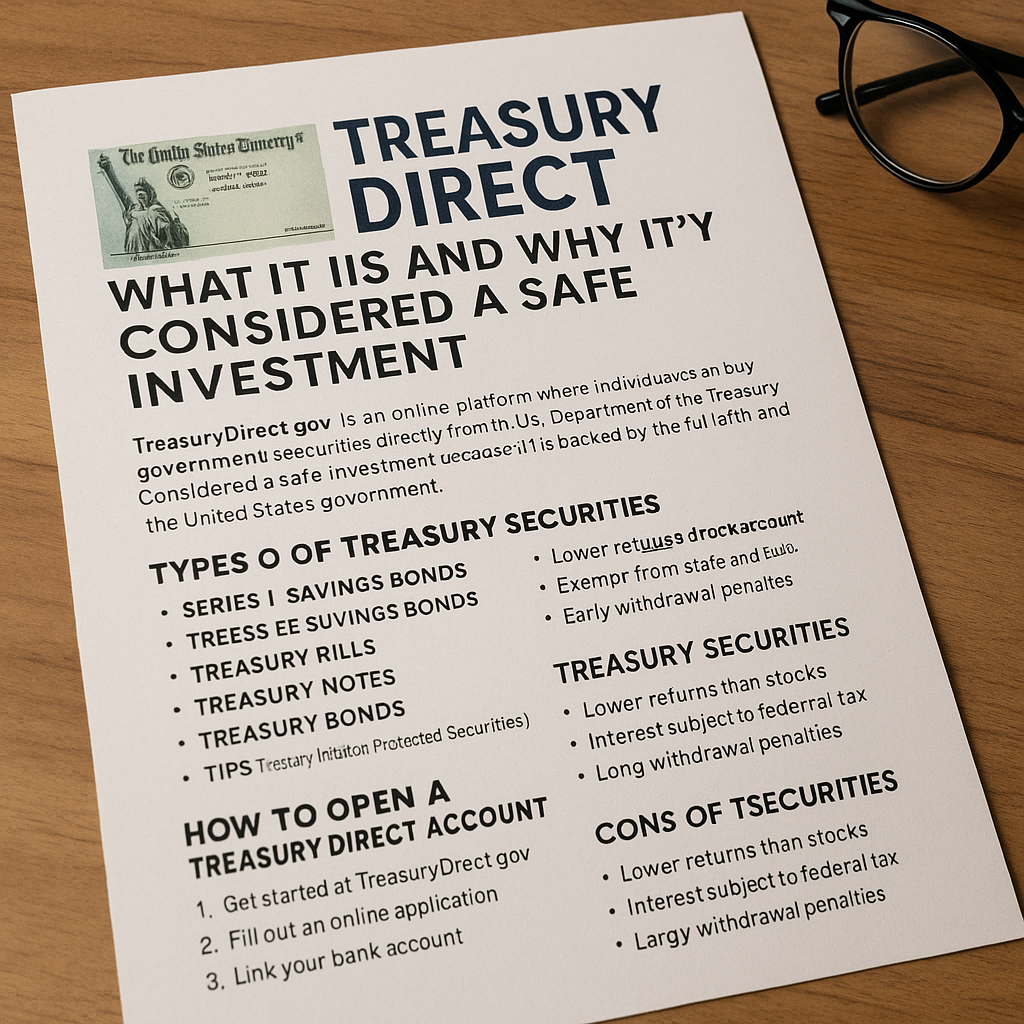

What Is Treasury Direct?

TreasuryDirect.gov is an online platform operated by the U.S. Department of the Treasury that allows individuals to buy and manage government securities directly—without needing a broker.

Through Treasury Direct, you can invest in:

- Treasury Bills (T-Bills)

- Treasury Notes (T-Notes)

- Treasury Bonds

- Savings Bonds (Series I and EE)

- TIPS (Treasury Inflation-Protected Securities)

These are all types of government-backed investments, meaning your money is effectively lent to the federal government—and it pays you back with interest.

Why Is Treasury Direct Considered So Safe?

Treasury securities are often referred to as “risk-free investments” because:

- They are backed by the full faith and credit of the U.S. government.

- There is virtually zero risk of default.

- They provide guaranteed interest payments (fixed or inflation-adjusted).

While returns are typically lower than stocks or mutual funds, the safety makes them ideal for preserving capital, especially during uncertain times.

Types of Securities You Can Buy on Treasury Direct

1. Series I Savings Bonds

- Earn interest based on a fixed rate + inflation rate

- Great for protecting against inflation

- You can buy up to $10,000 per year online

- Must be held for at least 1 year (penalty if redeemed before 5 years)

2. Series EE Savings Bonds

- Fixed interest rate

- Double in value after 20 years (if held to maturity)

- Ideal for long-term savings goals

3. Treasury Bills (T-Bills)

- Short-term (4 to 52 weeks)

- Sold at a discount, paid at face value upon maturity

- No interest—profit comes from the price difference

4. Treasury Notes (T-Notes)

- Medium-term (2 to 10 years)

- Pay interest every 6 months

- Return principal at the end of the term

5. Treasury Bonds

- Long-term (20 to 30 years)

- Pay semiannual interest

- Stable for long-range retirement planning

6. TIPS (Treasury Inflation-Protected Securities)

- Adjusted for inflation (principal increases with CPI)

- Pay interest every 6 months

- Protect your purchasing power

How to Open a Treasury Direct Account

Opening an account is free and takes only a few minutes. Here’s how:

- Visit TreasuryDirect.gov

- Click “Open an Account”

- Provide your:

- Social Security Number (SSN)

- U.S. address and bank account details

- Email and phone number

Once set up, you can buy bonds directly with funds from your linked bank account.

Who Should Invest in Treasury Securities?

Treasury Direct is great for:

- Beginners who want low-risk investments

- Conservative investors who value safety over high returns

- People saving for medium- to long-term goals

- Those concerned about inflation (Series I and TIPS help protect your money’s value)

If you’re risk-averse or nearing retirement, these assets can bring stability to your portfolio.

Pros of Treasury Direct

- No middlemen or fees

- Highly secure platform

- Access to a wide range of securities

- Tax advantages (interest is exempt from state and local taxes)

Cons of Treasury Direct

- Lower returns compared to stocks or mutual funds

- Not as liquid—some securities require holding periods

- User interface is outdated and may be confusing at first

Still, for the level of safety offered, many find these trade-offs acceptable.

Common Myths About Treasury Direct

“Only experts can invest.”

False—any U.S. citizen or resident can open an account and start with as little as $25.

“You don’t earn much.”

It depends on the product. Series I Bonds, for example, have offered inflation-adjusted rates of over 6% in recent years.

“It’s too complicated.”

While the website isn’t the most modern, the process is straightforward once you understand the basics.

Final Thoughts: Is Treasury Direct Right for You?

If your goal is to grow your savings with minimal risk, Treasury Direct is one of the most dependable options out there. Whether you’re saving for college, protecting money from inflation, or simply want a stable place to park funds—you can’t go wrong with U.S. Treasury securities.

Start small, explore the options, and get familiar with the platform. It’s a great stepping stone into the world of investing—without the stress or volatility of the stock market.

Sem comentários