Whether you’re just starting out or recovering from past financial mistakes, building good credit is one of the most important steps toward long-term financial health. A strong credit score opens the door to better loan rates, housing options, and even job opportunities.

In this article, you’ll learn step-by-step how to build (or rebuild) your credit from scratch—without falling into debt traps.

Why Good Credit Matters

Your credit score impacts:

- Loan approvals and interest rates

- Credit card eligibility

- Apartment and rental applications

- Utility deposits

- Car and home insurance premiums

- Some job background checks

With strong credit, you’ll pay less, access more, and stress less.

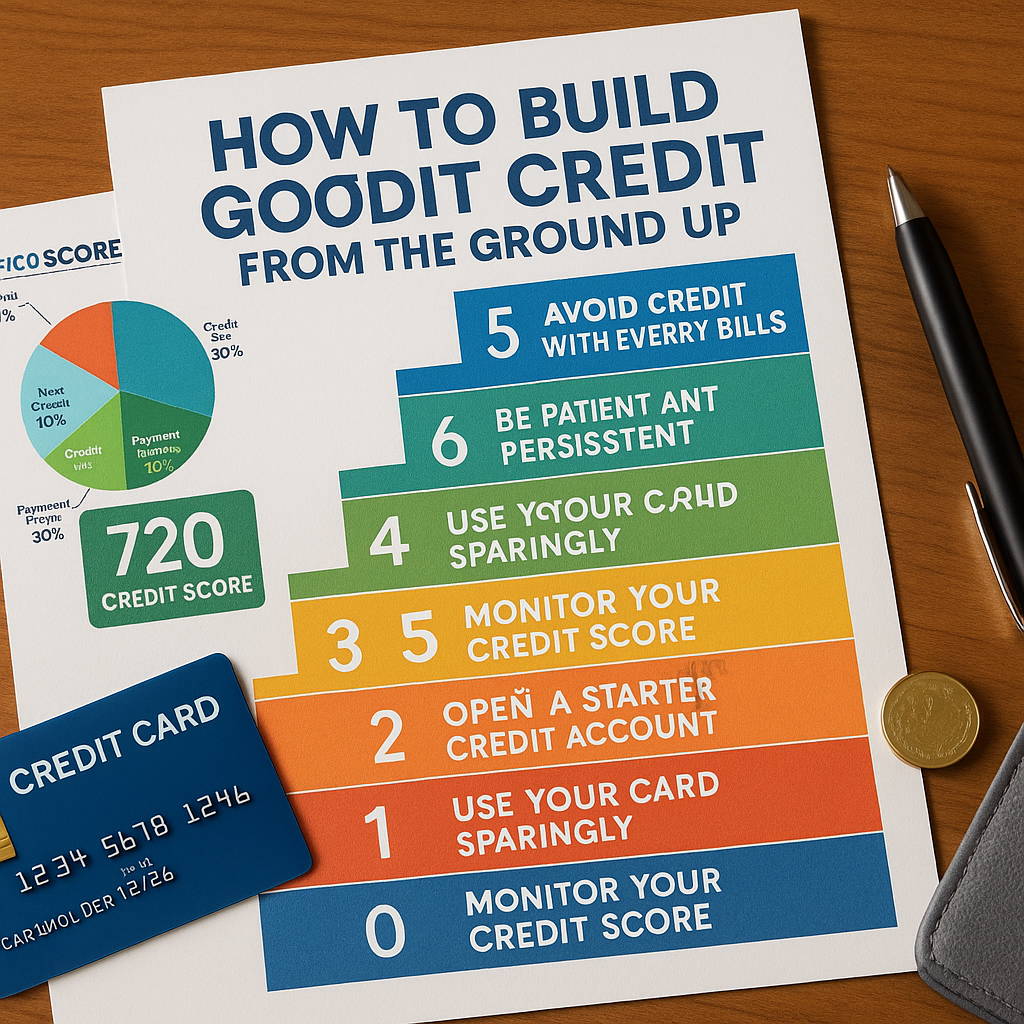

Step 1: Understand How Credit Scores Work

The most common score is the FICO Score, ranging from 300 to 850.

Key Factors:

- 35% Payment history – Pay on time, every time

- 30% Amounts owed (credit utilization) – Keep balances low

- 15% Length of credit history – Older is better

- 10% Credit mix – A mix of credit cards, loans, etc.

- 10% New credit – Too many applications can hurt

Step 2: Open a Starter Credit Account

If you have no credit, start small and safe.

Best options:

- Secured credit card – Requires a refundable deposit (often $200–$500)

- Credit-builder loan – You pay monthly into a locked account, and get the money later

- Become an authorized user – Ask a trusted person to add you to their credit card

- Student credit cards – If you’re in college, these can be more accessible

Choose just one to start. Use it responsibly.

Step 3: Use Your Card—but Sparingly

Credit is about activity and responsibility—not just having a card.

Guidelines:

- Use your card regularly (e.g., for gas or groceries)

- Keep your credit utilization below 30%

(i.e., spend no more than $30 if your limit is $100) - Pay your full balance every month

- Never miss a due date (set up auto-pay!)

Consistency builds trust with lenders.

Step 4: Monitor Your Credit Score

Knowing your score helps you track progress and spot issues.

Free options:

- Credit Karma

- Experian

- Your bank or credit card issuer

- AnnualCreditReport.com (free reports from all bureaus)

Check monthly for accuracy and fraud.

Step 5: Avoid Common Credit Pitfalls

Stay clear of mistakes that can damage your score:

- Missing payments – even one can hurt

- Maxing out cards – hurts utilization and creates stress

- Applying for too many cards – too many inquiries

- Closing old accounts – reduces credit history length

- Carrying balances – pay in full if possible

Remember: responsible credit use is a long game.

Step 6: Build Credit With Everyday Bills (Optional)

Some services now report regular bills to credit agencies.

Examples:

- Experian Boost – Adds payments for utilities, Netflix, phone

- Rental reporting services – Adds your rent history to your credit file

It’s a good way to improve your score with bills you already pay.

Step 7: Be Patient and Persistent

Credit takes time to build—but it’s worth it.

- Your first score may take 3–6 months to appear

- Scores improve with steady use and on-time payments

- The longer your accounts stay open, the stronger your history

Track your progress every few months and celebrate improvements.

Final Thoughts: Credit Is a Tool, Not a Trap

Used wisely, credit can help you unlock major life goals—like buying a home, starting a business, or traveling more affordably.

Start small, stay consistent, and remember: building good credit is not about perfection—it’s about progress.

Sem comentários