If you want to take control of your money and reach your goals faster, you need more than good intentions—you need a financial plan. Think of it as a roadmap that guides your daily decisions and long-term strategies.

Don’t worry—you don’t need a financial advisor or fancy tools. In this article, you’ll learn how to build a simple, personalized financial plan that fits your lifestyle and evolves with you.

Why You Need a Financial Plan

A good plan helps you:

- Clarify your money goals

- Prioritize your spending

- Save more and spend wisely

- Reduce financial stress

- Prepare for the unexpected

- Stay focused on long-term progress

Without a plan, it’s easy to drift, overspend, or lose sight of what really matters.

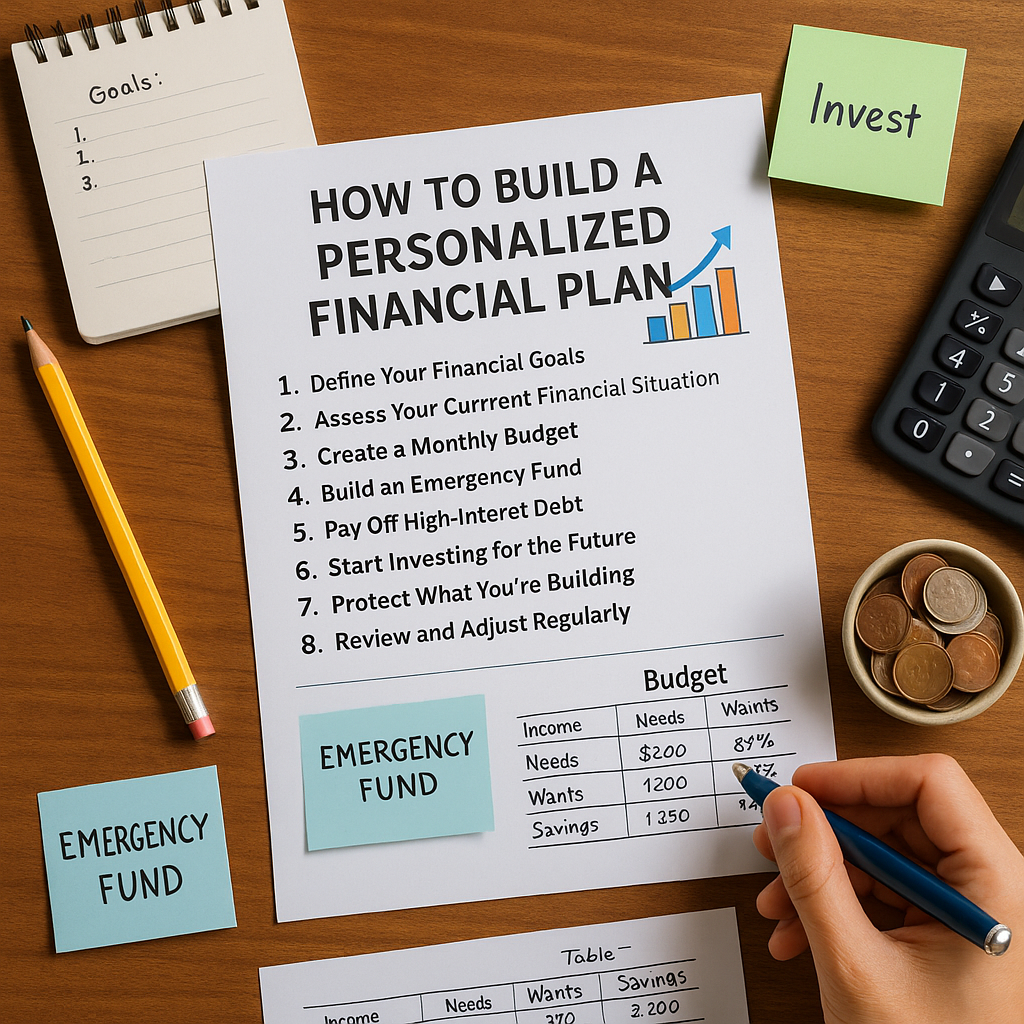

Step 1: Define Your Financial Goals

Start by writing down 3–5 goals that reflect what you want your money to do for you.

Examples:

- Pay off $5,000 in credit card debt

- Save $10,000 for a home down payment

- Build a 6-month emergency fund

- Start investing $200/month for retirement

- Take a vacation without using credit

Make your goals SMART: Specific, Measurable, Achievable, Relevant, Time-bound.

Step 2: Assess Your Current Financial Situation

Get a clear picture of where you stand today.

Gather:

- Monthly income (after tax)

- Fixed expenses (rent, loans, insurance)

- Variable expenses (groceries, fuel, dining out)

- Debts (balances + interest rates)

- Current savings and investments

Calculate your net worth:

Assets – Liabilities = Net Worth

This will show your starting point.

Step 3: Create a Monthly Budget

Your budget is the foundation of your plan.

Choose a method:

- 50/30/20 Rule

- Zero-based budgeting

- Envelope method

- App-based tools (YNAB, Mint, Goodbudget)

Make sure you include:

- Needs (50%)

- Wants (30%)

- Financial goals (20% or more if possible)

Track your spending and adjust monthly.

Step 4: Build an Emergency Fund

Before you invest heavily or pay off all debt, build a safety net.

Emergency Fund Basics:

- Start with $500–$1,000

- Grow to 3–6 months of expenses over time

- Keep it in a high-yield savings account

- Use only for real emergencies (job loss, car repair, medical bills)

This gives you peace of mind and prevents debt in a crisis.

Step 5: Pay Off High-Interest Debt

Debt eats into your future. Make a plan to eliminate it.

Use either:

- Snowball Method: pay off smallest debts first

- Avalanche Method: pay off highest-interest debts first

Pay more than the minimums and avoid taking on new consumer debt.

Step 6: Start Investing for the Future

Once you have a small emergency fund and a handle on debt, start investing—even small amounts.

Focus on:

- Employer 401(k) (especially if there’s a match)

- Roth IRA or Traditional IRA

- Low-cost index funds or ETFs

- Robo-advisors for automation

The earlier you start, the more compound interest works in your favor.

Step 7: Protect What You’re Building

Your financial plan should include protection against setbacks.

Important areas:

- Health insurance

- Renters or homeowners insurance

- Disability insurance

- Life insurance (especially if you have dependents)

Also, consider creating a basic will or estate plan.

Step 8: Review and Adjust Regularly

Life changes—and so should your financial plan.

Review every 3–6 months:

- Are you hitting your savings targets?

- Have your goals changed?

- Are there new income or expenses to plan for?

- Is your budget still working for your lifestyle?

Stay flexible and committed.

Final Thoughts: You Don’t Need to Be Perfect—Just Consistent

You don’t have to know everything about money. You just need a simple, personal plan—and the discipline to follow it step by step.

Start where you are. Use what you have. And remember: every dollar you manage with intention moves you closer to the life you want.

Sem comentários