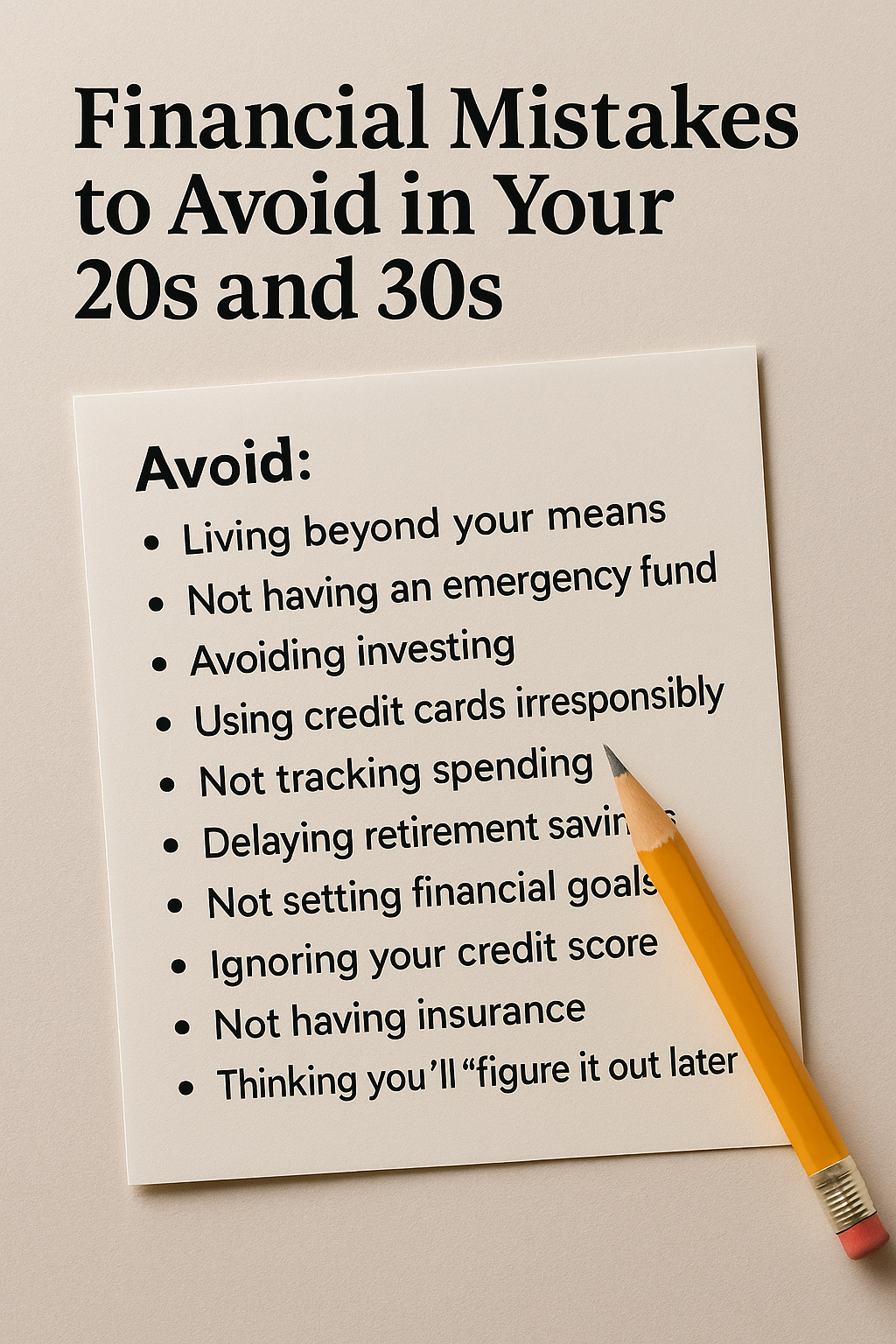

Your 20s and 30s are a crucial time for building the foundation of your financial future. The habits and decisions you make now can set you up for long-term success—or create problems that take years to fix.

In this article, we’ll highlight the most common financial mistakes young adults make and offer tips on how to avoid them. Whether you’re just starting your career or working toward stability, these insights will help you take smarter steps forward.

1. Living Beyond Your Means

It’s tempting to keep up with friends, trends, or social media lifestyles—but spending more than you earn leads to debt and stress.

What to do instead:

- Create a realistic monthly budget

- Track your expenses

- Prioritize needs over wants

- Delay unnecessary purchases

Tip: Just because you qualify for a credit card doesn’t mean you should use it for everything.

2. Not Having an Emergency Fund

Emergencies happen—job loss, medical bills, car repairs. Without savings, you’re forced to rely on credit or loans.

What to do instead:

- Start with $500 to $1,000

- Work up to 3–6 months of essential expenses

- Keep it in a high-yield savings account

Even a small buffer can make a big difference in a crisis.

3. Avoiding Investing Because It Seems Complicated

Many young people avoid investing because they think it’s risky or too hard to understand. The real risk is waiting too long to start.

What to do instead:

- Start early—even with $20/month

- Use robo-advisors or low-fee index funds

- Invest through retirement accounts (401(k), IRA)

Compound interest rewards time more than money. Start now.

4. Using Credit Cards Irresponsibly

Credit cards are powerful tools—but also dangerous if misused. High-interest debt builds fast and can harm your credit score.

What to do instead:

- Use credit cards only if you can pay the full balance monthly

- Set up automatic payments

- Avoid using cards for wants or luxuries

If you’re carrying a balance, focus on paying it down as fast as possible.

5. Not Tracking Where Your Money Goes

Without visibility, it’s easy to overspend or forget about recurring charges and subscriptions.

What to do instead:

- Review your bank and credit statements monthly

- Use budgeting apps (like Mint, YNAB, or PocketGuard)

- Cancel unused subscriptions

- Identify spending leaks

You can’t fix what you don’t measure.

6. Delaying Retirement Savings

Retirement might feel far away—but your future self will thank you for starting early.

What to do instead:

- Contribute to a 401(k) if your employer offers one

- Open a Roth or Traditional IRA

- Aim for at least 10–15% of your income (start smaller if needed)

Starting in your 20s means you can contribute less and still retire with more.

7. Not Setting Financial Goals

Without goals, your money drifts. Goals give direction and purpose to your efforts.

What to do instead:

- Set short-, medium-, and long-term financial goals

- Make them SMART (Specific, Measurable, Achievable, Relevant, Time-bound)

- Break big goals into monthly steps

Examples: Save $1,000 for emergencies, pay off $2,000 in credit card debt, invest $200/month.

8. Ignoring Your Credit Score

Your credit score affects loans, renting, job applications, and even insurance rates. Don’t ignore it.

What to do instead:

- Check your score monthly with free tools (Credit Karma, Experian)

- Pay bills on time

- Keep credit utilization under 30%

- Dispute any errors on your credit report

Good credit = better financial opportunities.

9. Not Having Health or Renters Insurance

Insurance might seem like an unnecessary cost—until you need it.

What to do instead:

- Always have health insurance to protect against huge medical bills

- If you rent, get renters insurance to protect your belongings

- Look for low-cost options that fit your budget

It’s better to be covered than caught off guard.

10. Thinking You’ll “Figure It Out Later”

Financial wellness doesn’t happen by accident. The sooner you start, the easier it becomes.

What to do instead:

- Learn basic financial literacy

- Ask questions, read books, follow finance blogs or podcasts

- Talk to people you trust

- Take small steps—consistency matters more than perfection

Final Thoughts: Build Smart Habits Now

Your 20s and 30s are your launchpad. Avoiding common financial mistakes now will save you years of stress later. Be proactive, stay curious, and make decisions that your future self will appreciate.

You don’t have to be rich to be financially wise. You just need a plan—and the courage to stick to it.

Sem comentários