Whether you want to get out of debt, save for a dream vacation, or build long-term wealth, one thing is certain: you need a plan. That starts with setting clear, realistic financial goals—and more importantly, learning how to actually achieve them. In this article, we’ll walk you through how to set smart financial goals, avoid […]

Most people work hard for their money—but not everyone knows how to make their money work for them. The truth is, financial freedom doesn’t just come from earning more; it comes from using what you have wisely and consistently. In this article, you’ll learn how to build smart financial habits that help your money grow, […]

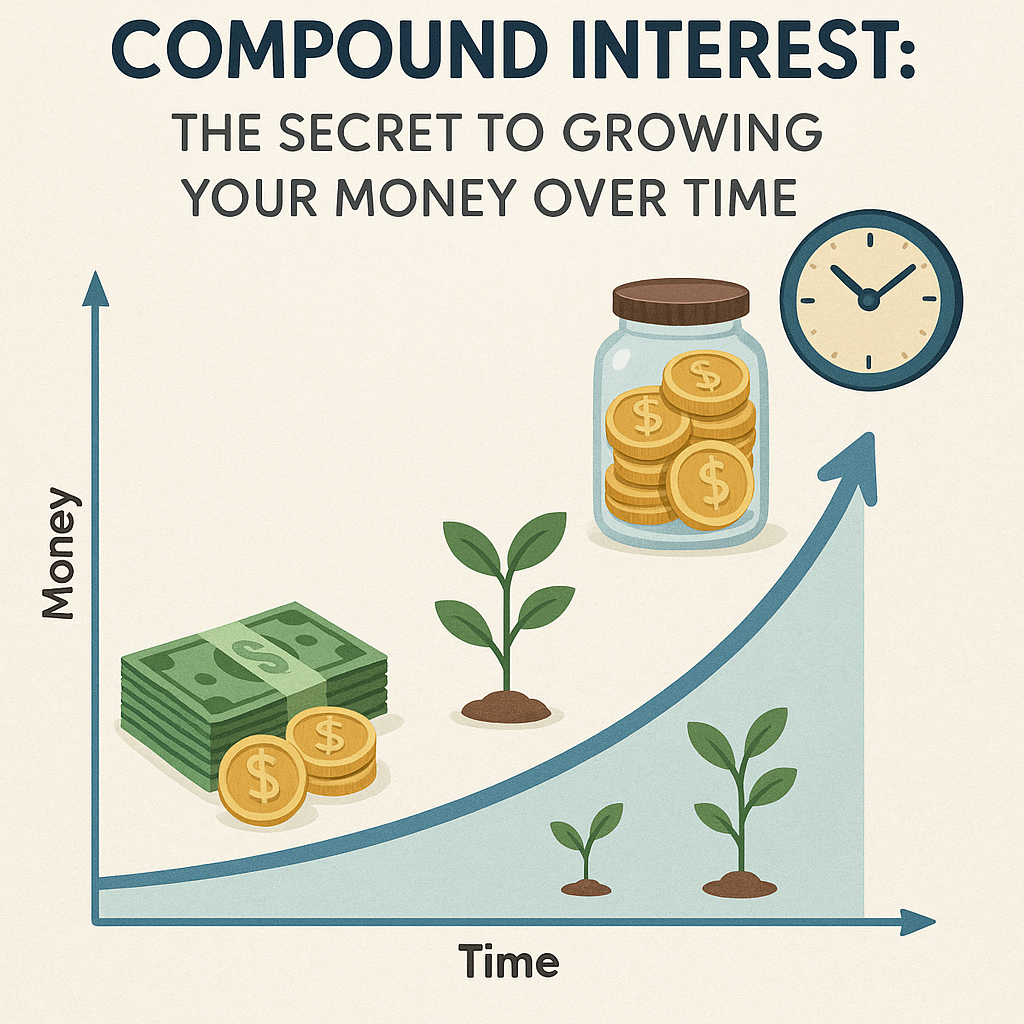

If you’re looking to build wealth, reach financial goals, or simply make your money work harder, you need to understand one powerful concept: compound interest. Often called “the eighth wonder of the world,” compound interest can turn small, consistent savings into a substantial amount over time—even if you’re not a financial expert or high earner. […]

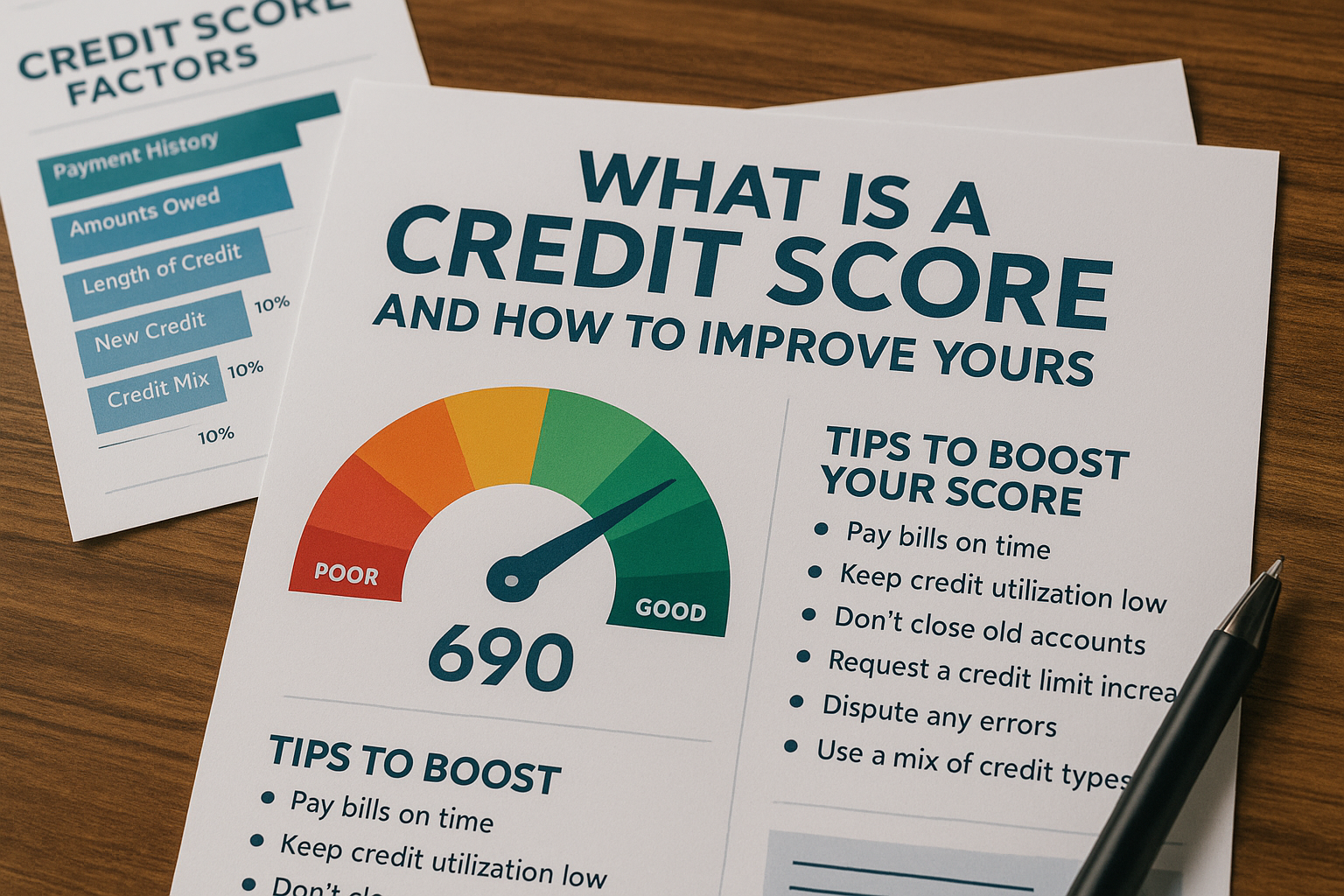

If you’ve ever applied for a loan, rented an apartment, or used a credit card, your credit score has likely played a big role. But what exactly is a credit score? Why does it matter? And how can you improve yours? In this article, we’ll break down what a credit score is, how it’s calculated, […]

Being in debt can be overwhelming—especially when the bills keep coming and your credit score takes a hit. But you’re not alone, and there is a way out. Whether it’s credit cards, personal loans, or overdue bills, you can negotiate your debts and regain control of your financial life. In this article, you’ll learn how […]

Saving money can feel impossible when you’re living paycheck to paycheck. But no matter how much you earn, it’s possible to build better financial habits and create a buffer for emergencies and future goals. You don’t need a six-figure salary to start saving—you just need the right mindset and a solid plan. In this article, […]

When you start learning about investing, one of the first concepts you’ll encounter is the difference between fixed income and variable income investments. Understanding these categories is essential to building a strategy that aligns with your goals, timeline, and risk tolerance. In this article, we’ll break down what each type means, their pros and cons, […]

Life is full of surprises—some exciting, and others expensive. A sudden job loss, a medical bill, or a car repair can turn your finances upside down if you’re not prepared. That’s why every solid financial plan starts with one thing: an emergency fund. In this article, you’ll learn what an emergency fund is, why it […]

Keeping track of your spending and sticking to a budget used to mean juggling paper receipts and spreadsheets. Today, it’s easier than ever to manage your money with just your smartphone. Whether you’re trying to pay off debt, build an emergency fund, or simply understand where your money goes each month, finance apps can make […]

Have you ever walked into a store for one thing and walked out with five? Or made a late-night online purchase that you regretted the next day? If so, you’re not alone. Impulsive spending is a common challenge—and one of the biggest obstacles to achieving financial stability. In this article, you’ll learn why impulsive spending […]