Imagine waking up knowing your bills are covered, your savings are growing, and you have the freedom to choose how to spend your time—not just survive to your next paycheck. That’s financial freedom—and it’s not just for the wealthy. Anyone can achieve financial freedom with the right mindset, plan, and consistent effort. In this final […]

Whether you’re just starting out or recovering from past financial mistakes, building good credit is one of the most important steps toward long-term financial health. A strong credit score opens the door to better loan rates, housing options, and even job opportunities. In this article, you’ll learn step-by-step how to build (or rebuild) your credit […]

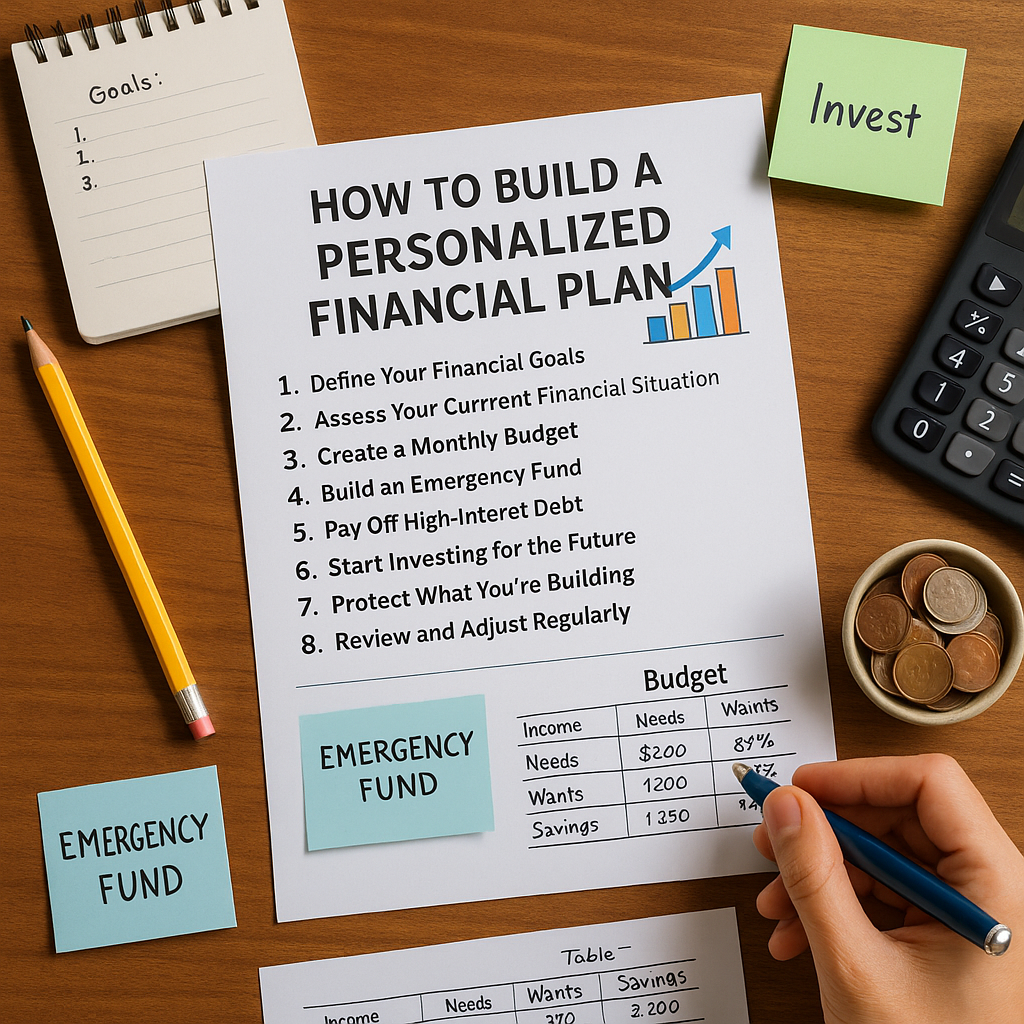

If you want to take control of your money and reach your goals faster, you need more than good intentions—you need a financial plan. Think of it as a roadmap that guides your daily decisions and long-term strategies. Don’t worry—you don’t need a financial advisor or fancy tools. In this article, you’ll learn how to […]

Getting a raise, landing a new job, or increasing your income should improve your financial life—but it often doesn’t. Why? Because of lifestyle inflation. Also known as lifestyle creep, this silent budget-killer happens when your spending rises as your income does. The result? You feel just as broke as before, even while earning more. In […]

Opening a bank account seems simple—until you realize just how many options exist. Traditional banks, online banks, credit unions, checking vs. savings accounts… How do you know which one is right for your financial goals? In this article, we’ll break down how to choose the best bank account for your lifestyle, needs, and money habits—step […]

Do you feel nervous every time you check your bank account? Lose sleep over bills or debt? You’re not alone. Financial anxiety affects millions of people—regardless of income level. The good news? You can manage financial anxiety with awareness, mindset shifts, and practical steps that restore your confidence and sense of control. In this article, […]

Achieving financial goals isn’t just about numbers—it’s about motivation, clarity, and vision. One of the most powerful ways to stay inspired on your money journey is by creating a financial vision board. A vision board makes your goals visible, emotional, and tangible. It reminds you why you’re budgeting, saving, or paying off debt—even when it […]

Managing your money doesn’t have to be complicated—or boring. Thanks to financial apps, you can budget, track spending, save money, and even invest right from your phone. The key is using the right tools to support your habits and goals. In this article, we’ll explore how financial apps can improve your daily money management, highlight […]

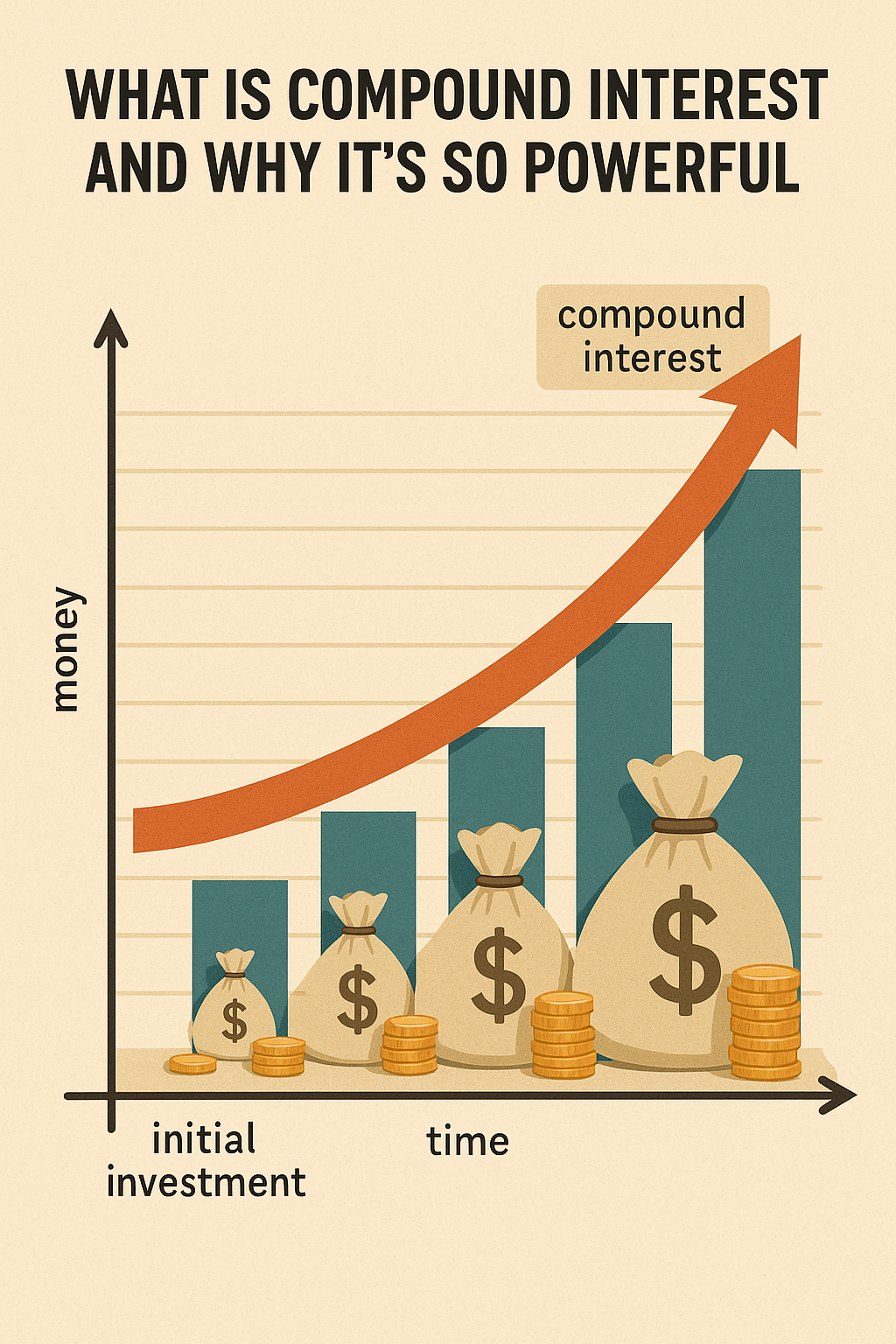

If there’s one concept in personal finance that can change your life, it’s compound interest. Albert Einstein allegedly called it the “eighth wonder of the world”—and for good reason. Compound interest is the key to building wealth slowly, steadily, and almost effortlessly—as long as you start early and stay consistent. In this article, we’ll explain […]

When it comes to personal finance, your net worth is one of the most important numbers to know. It gives you a clear snapshot of your overall financial health—beyond just how much you earn or spend each month. In this article, you’ll learn what net worth is, how to calculate it, and why tracking it […]