Have you ever walked into a store for one thing and walked out with five? Or made a late-night online purchase that you regretted the next day? If so, you’re not alone. Impulsive spending is a common challenge—and one of the biggest obstacles to achieving financial stability. In this article, you’ll learn why impulsive spending […]

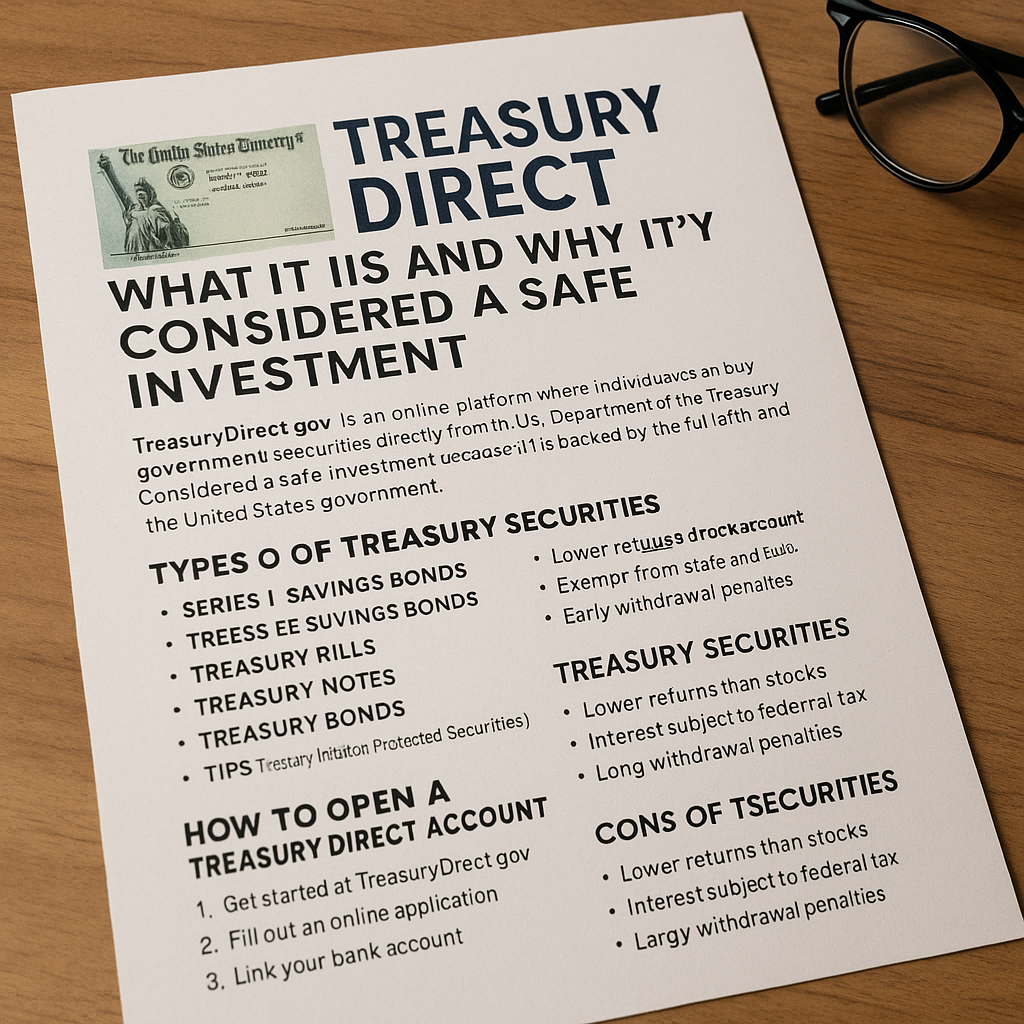

If you’re new to investing and looking for a safe, stable place to grow your money, you’ve probably heard of Treasury Direct. It’s one of the most beginner-friendly ways to invest, backed by the government and accessible online. In this article, we’ll explain exactly what Treasury Direct is, how it works, and why so many […]

For many people, the word “investing” sounds intimidating—like something only for the wealthy or those with advanced financial knowledge. But the truth is: anyone can start investing, and the sooner you begin, the more time your money has to grow. This article will guide you through the basics of investing for beginners. You’ll learn where […]

Managing money doesn’t have to be complicated. If you’re new to budgeting and looking for a simple way to control your spending while still reaching your goals, the 50/30/20 rule is one of the easiest and most effective methods to start with. In this article, you’ll learn exactly what the 50/30/20 rule is, how it […]

Living in overdraft can feel like you’re constantly chasing your next paycheck just to break even. It’s stressful, expensive, and can keep you stuck in a cycle of debt. But the good news is: it’s possible to escape overdraft and regain financial stability—with a clear and realistic plan. This article will guide you step-by-step on […]

Credit cards can be powerful financial tools when used responsibly—but they can also lead to serious debt if mismanaged. For many beginners, credit cards seem convenient and helpful, but without a strategy, they can quickly become a trap of high interest rates and missed payments. In this article, you’ll learn how to use your credit […]

Creating a household budget is one of the smartest steps you can take toward financial stability. It allows you to take control of your money, plan for expenses, and achieve your short- and long-term goals with confidence. Whether you’re living alone or managing a family, a clear budget helps you spend wisely, save consistently, and […]

In a world where money affects nearly every aspect of daily life—housing, food, education, health, and even relationships—understanding how to manage it is essential. That’s where financial literacy comes in. It’s not just a buzzword; it’s a critical life skill that can make the difference between surviving and thriving. In this article, we’ll explain what […]

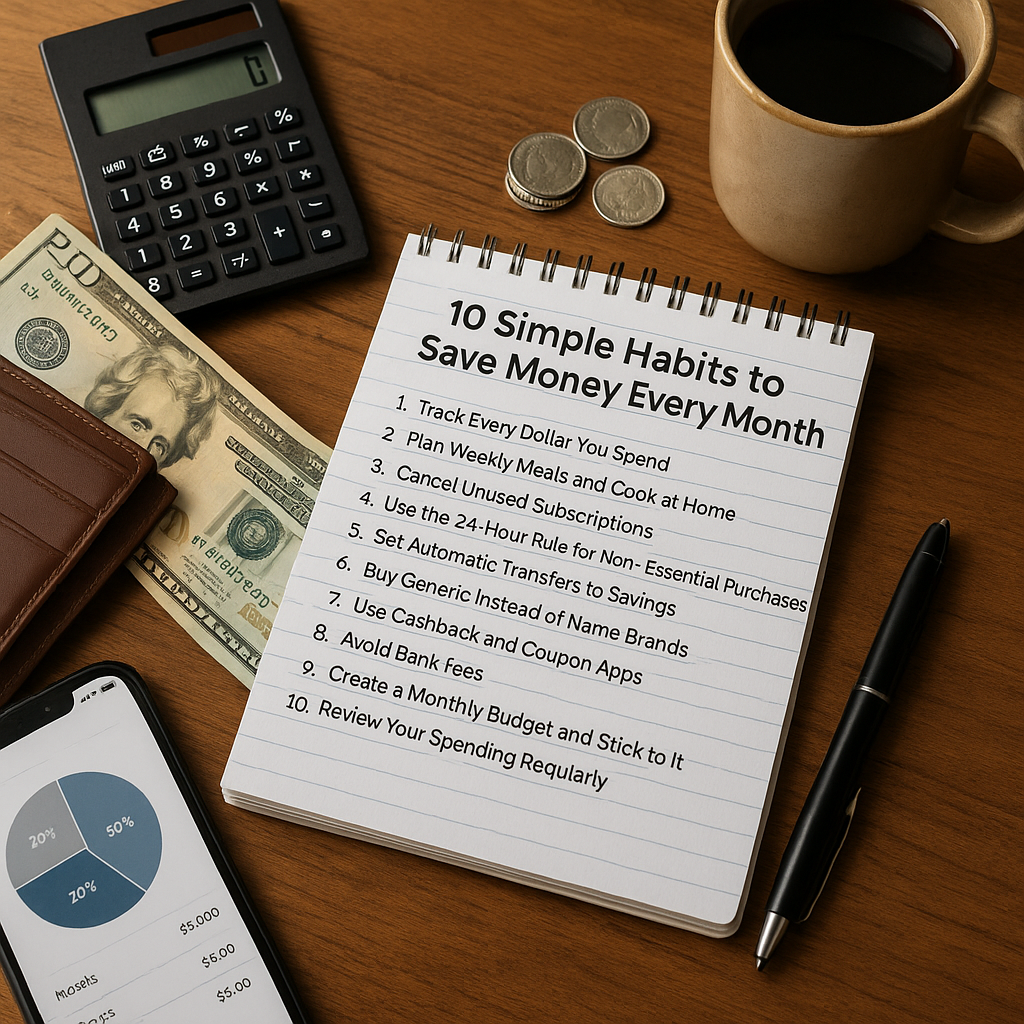

Saving money doesn’t have to involve drastic lifestyle changes or complicated financial tools. In fact, developing a few simple, consistent habits can lead to major savings over time. Whether you’re trying to pay off debt, build an emergency fund, or just make your income go further, adopting the right routines can transform your finances. Here […]

Getting your personal finances in order is one of the most empowering steps you can take toward financial freedom and long-term stability. Whether you’re starting your financial journey from scratch or trying to fix years of poor money habits, it’s never too late to gain control over your money. In this article, we’ll walk through […]