Saving money doesn’t have to involve drastic lifestyle changes or complicated financial tools. In fact, developing a few simple, consistent habits can lead to major savings over time. Whether you’re trying to pay off debt, build an emergency fund, or just make your income go further, adopting the right routines can transform your finances.

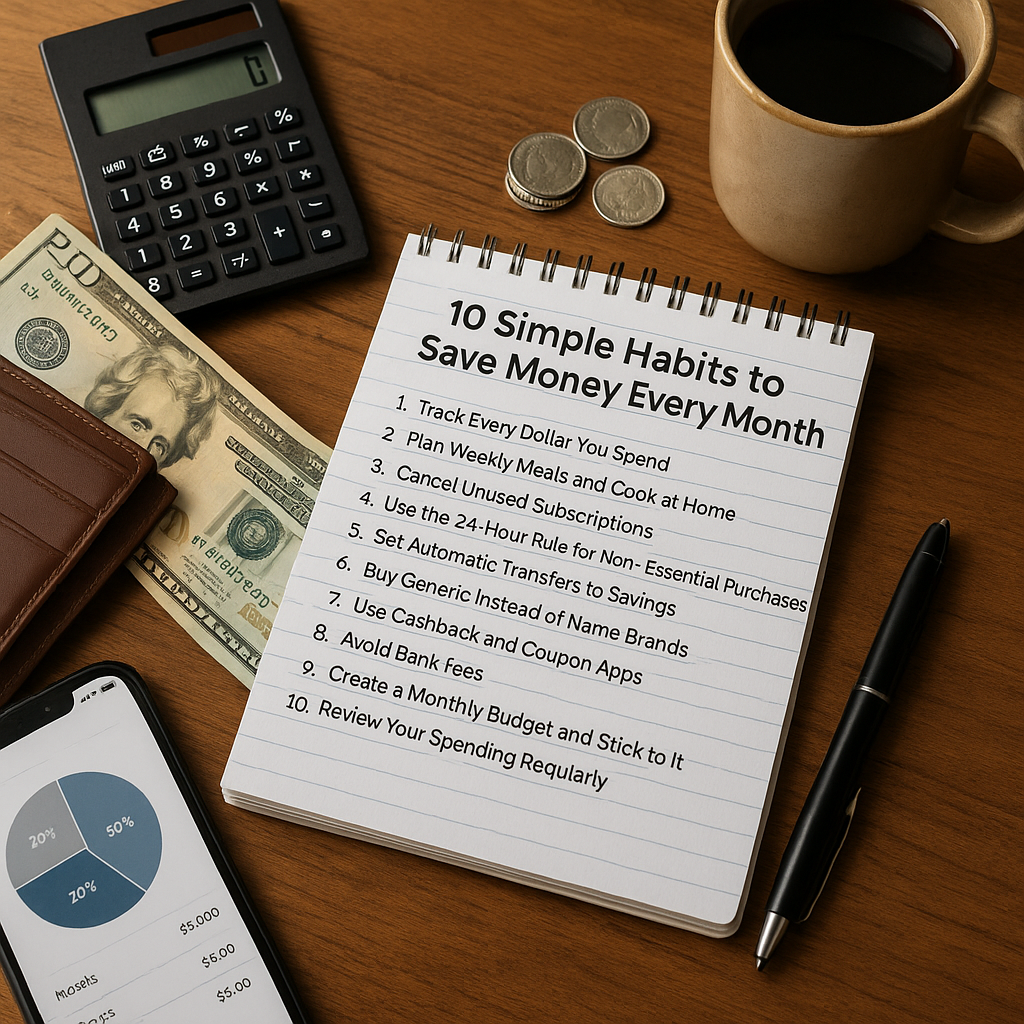

Here are 10 easy-to-follow habits that can help you save money every single month.

1. Track Every Dollar You Spend

The first step in saving is knowing exactly where your money is going. Many people underestimate how much they spend on small, everyday items like coffee, takeout, or app subscriptions.

Action tip: Use apps like PocketGuard, Mint, or even a basic spreadsheet to monitor your spending. When you see the full picture, it’s easier to identify what you can cut back on.

2. Plan Weekly Meals and Cook at Home

Eating out may be convenient, but it’s one of the fastest ways to overspend. Planning meals at home saves money and often results in healthier choices.

Action tip: Create a weekly meal plan and grocery list based on what’s on sale. Batch cooking and using leftovers also reduce waste and costs.

3. Cancel Unused Subscriptions

Many people continue to pay for digital subscriptions they no longer use—music, video, fitness, or apps.

Action tip: Review your bank or credit card statements and cancel anything you haven’t used in the last 30 days. Those small charges add up over time.

4. Use the 24-Hour Rule for Non-Essential Purchases

Impulse buys are the enemy of smart saving. Before buying anything that’s not essential, wait 24 hours.

Action tip: Add the item to a “wish list” instead of your cart. After a day, you might realize you don’t need it after all.

5. Set Automatic Transfers to Savings

Saving becomes easier when it happens without you thinking about it. Automating the process ensures you pay yourself first.

Action tip: Set up a recurring transfer to your savings account each payday—even if it’s just $20. Over time, it adds up significantly.

6. Buy Generic Instead of Name Brands

Brand loyalty can cost more than it’s worth. In most cases, generic or store-brand products are just as good and much cheaper.

Action tip: Compare ingredients and labels. Start with items like cleaning supplies, medicine, or pantry staples to switch without sacrificing quality.

7. Use Cashback and Coupon Apps

Get money back on things you were going to buy anyway. Cashback programs and coupon apps provide small rewards that accumulate over time.

Action tip: Use apps like Rakuten, Honey, or Ibotta when shopping online or in-store. Combine cashback with sales for maximum benefit.

8. Avoid Bank Fees

Monthly maintenance fees, ATM charges, and overdraft penalties can quietly drain your funds.

Action tip: Choose a checking account with no fees, use your bank’s ATMs, and keep a buffer in your account to avoid overdrafts.

9. Create a Monthly Budget and Stick to It

Without a clear plan, it’s easy to overspend. A budget tells your money where to go instead of wondering where it went.

Action tip: Start with a simple structure like 50% for needs, 30% for wants, and 20% for savings and debt. Adjust as your goals evolve.

10. Review Your Spending Regularly

Make it a habit to reflect on your finances at the end of each month. You’ll be able to see what worked, what didn’t, and how you can improve.

Action tip: Set a recurring calendar reminder to check your expenses, track progress, and make any necessary adjustments.

Keep the Momentum Going

Saving money isn’t about being perfect—it’s about being consistent. By turning these 10 habits into part of your routine, you’ll gradually build a strong financial foundation. The key is to start small and stick with it.

Small choices made daily can lead to big results over time. Saving money becomes easier when it’s a lifestyle, not a one-time fix. You have the power to take control of your finances—one habit at a time.

Sem comentários