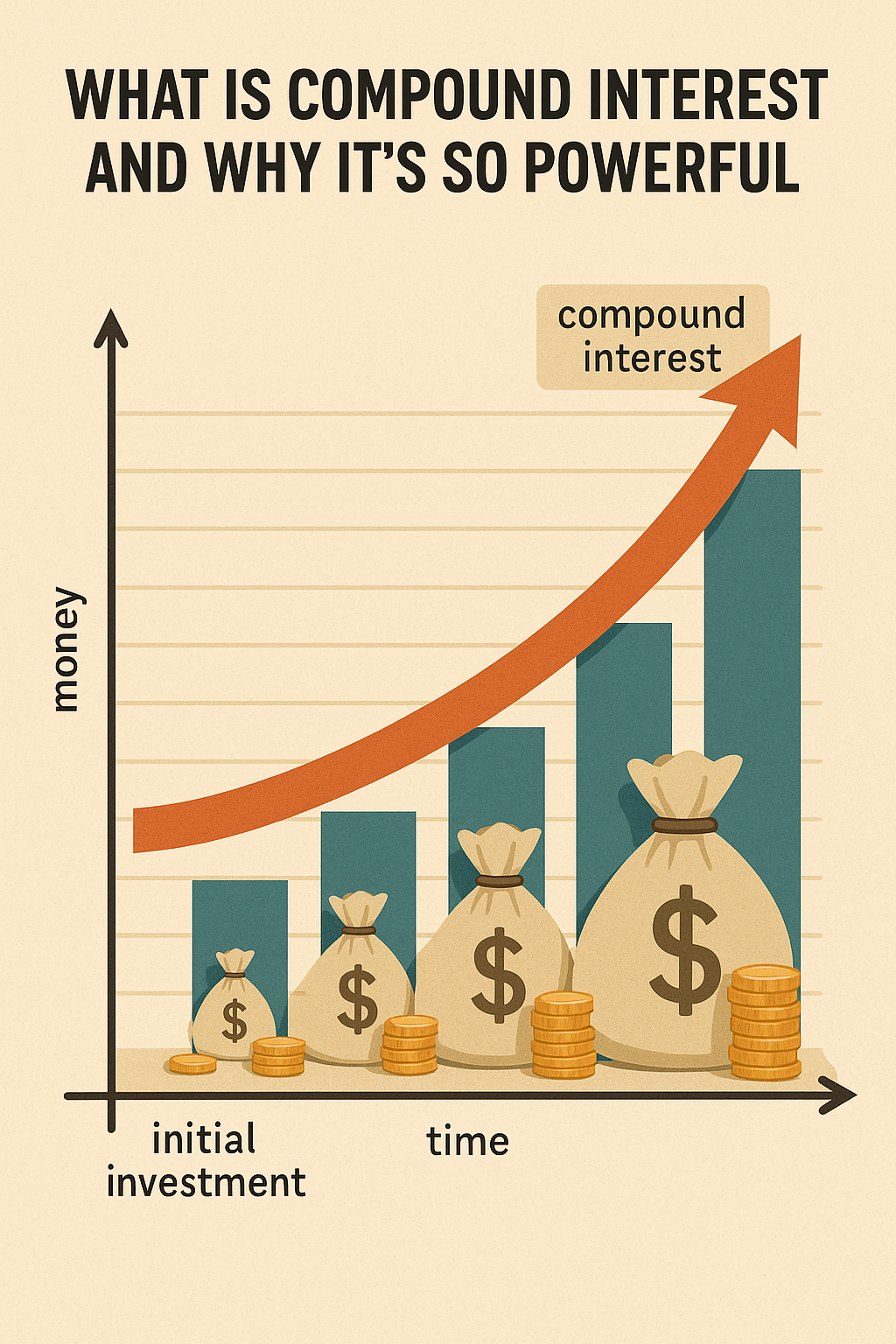

If there’s one concept in personal finance that can change your life, it’s compound interest. Albert Einstein allegedly called it the “eighth wonder of the world”—and for good reason.

Compound interest is the key to building wealth slowly, steadily, and almost effortlessly—as long as you start early and stay consistent.

In this article, we’ll explain what compound interest is, how it works, and how you can use it to grow your money faster over time.

What Is Compound Interest?

Compound interest is when you earn interest not only on your original amount (the principal) but also on the interest you’ve already earned.

It’s interest on top of interest. And over time, it creates a snowball effect that grows your money much faster than simple interest.

How It Works: A Simple Example

Let’s say you invest $1,000 at an annual interest rate of 10%, compounded yearly.

- Year 1: You earn $100 interest → total = $1,100

- Year 2: You earn 10% of $1,100 = $110 → total = $1,210

- Year 3: You earn 10% of $1,210 = $121 → total = $1,331

Notice how the interest increases each year even though you didn’t add more money. That’s the power of compounding.

Why Time Is the Secret Ingredient

The earlier you start, the more time your money has to grow.

Example:

- Start saving $100/month at age 25 → retire with ~$550,000

- Start saving $100/month at age 35 → retire with ~$275,000

- Start saving $100/month at age 45 → retire with ~$120,000

The amount you invest is the same—but starting earlier doubles or triples your outcome.

Compound Interest Formula

If you like math, here’s the standard formula:

A = P(1 + r/n)^(nt)

Where:

- A = final amount

- P = principal (starting amount)

- r = annual interest rate (as a decimal)

- n = number of times compounded per year

- t = number of years

You can also use online calculators to skip the math and visualize your results instantly.

Where to Find Compound Interest in Real Life

You can benefit from compound interest in many places:

✅ Investments:

- Stocks and ETFs

- Mutual funds

- Retirement accounts (401k, IRA)

- Reinvested dividends

✅ Savings Accounts:

- High-yield savings accounts

- Money market accounts

- Certificates of Deposit (CDs)

⚠️ Warning: Compound interest works against you with debt (like credit cards). Interest builds on unpaid interest, making debt grow fast.

How to Take Advantage of Compound Interest

1. Start as early as possible

Even small amounts grow significantly over time.

2. Invest consistently

Monthly contributions help build momentum—especially with automatic transfers.

3. Let it grow—don’t interrupt

The longer your money stays invested, the stronger the compounding effect.

4. Reinvest dividends

Don’t withdraw them. Let them compound along with the rest of your balance.

5. Be patient

The real magic happens over decades, not days.

Compound Interest vs. Simple Interest

| Type | Earns Interest On | Growth Rate |

|---|---|---|

| Simple Interest | Only the principal | Slower |

| Compound Interest | Principal + past interest | Faster (exponential) |

Compound interest is how you turn $1 into $10 over time.

Final Thoughts: Let Your Money Work for You

You don’t need to be rich or a math genius to benefit from compound interest. You just need time, consistency, and discipline.

Start now—no matter how small the amount. The earlier you begin, the more powerful your results. Let compound interest do the heavy lifting while you focus on your goals.

Sem comentários