If you’ve ever applied for a loan, rented an apartment, or used a credit card, your credit score has likely played a big role. But what exactly is a credit score? Why does it matter? And how can you improve yours?

In this article, we’ll break down what a credit score is, how it’s calculated, and what steps you can take—starting today—to boost your score and open the door to better financial opportunities.

What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness—how likely you are to repay borrowed money. Lenders, landlords, and even employers use this score to evaluate how financially responsible you are.

The Most Common Scoring Model:

FICO Score (ranges from 300 to 850)

| Credit Score Range | Rating |

|---|---|

| 800–850 | Excellent |

| 740–799 | Very Good |

| 670–739 | Good |

| 580–669 | Fair |

| 300–579 | Poor |

The higher your score, the more trust lenders place in you—and the better your chances of getting approved for loans and receiving lower interest rates.

Why Is a Good Credit Score Important?

- Lower interest rates on loans and credit cards

- Better chances of rental approval

- Higher chances of being approved for new credit

- Lower car insurance premiums (in some regions)

- Easier access to utilities or mobile plans without deposits

A good credit score saves you money and stress over time.

How Is Your Credit Score Calculated?

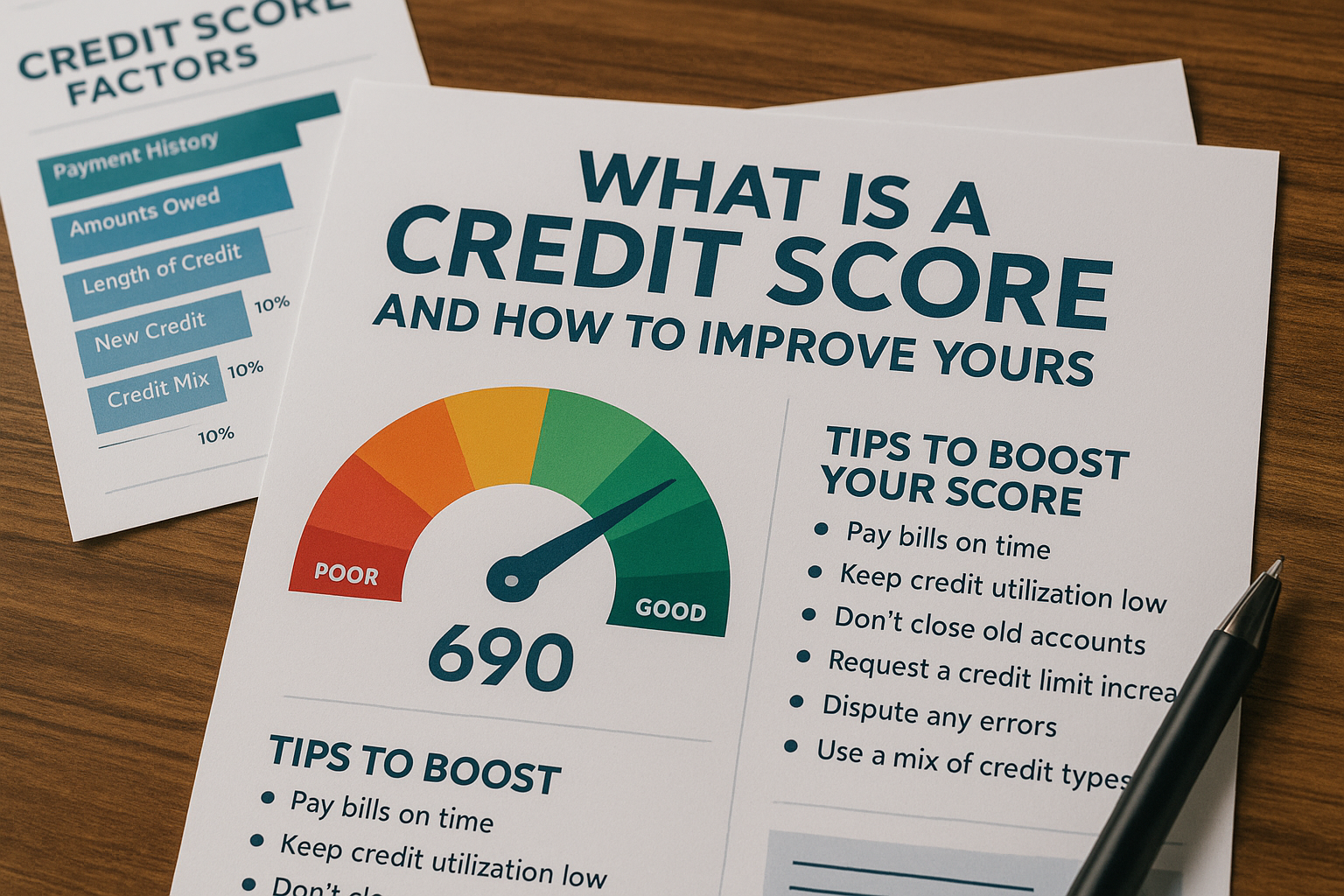

Different models use different formulas, but the FICO Score breakdown looks like this:

1. Payment History (35%)

Do you pay your bills on time?

2. Credit Utilization (30%)

How much of your available credit are you using? (Aim for under 30%)

3. Length of Credit History (15%)

How long have your accounts been open?

4. Credit Mix (10%)

Do you have different types of credit (e.g., loans, credit cards)?

5. New Credit (10%)

Have you recently applied for new credit? Too many inquiries can hurt your score.

How to Check Your Credit Score

You can check your credit score for free through:

- Credit card companies (many offer free scores)

- Credit monitoring apps like Credit Karma, Credit Sesame, or Experian

- AnnualCreditReport.com (for full credit reports)

Checking your own credit score does not hurt it—this is called a soft inquiry.

10 Ways to Improve Your Credit Score

1. Pay Your Bills on Time—Every Time

Even one late payment can seriously damage your score. Set up reminders or automatic payments for recurring bills.

2. Keep Your Credit Utilization Low

If your credit limit is $1,000, try to keep your balance below $300. Paying off your credit card in full each month is best.

3. Don’t Close Old Accounts

Older accounts help increase your average credit history. Even if you don’t use an old card, keeping it open can help your score.

4. Ask for a Credit Limit Increase

If your income has improved or you’ve been a customer for a while, ask for a higher credit limit—but don’t spend more. This lowers your utilization ratio.

5. Dispute Errors on Your Credit Report

Mistakes happen. Review your report and dispute any incorrect information that may be harming your score.

6. Become an Authorized User

Ask a trusted friend or family member to add you as an authorized user on their credit card. Their good payment history can help improve your score.

7. Avoid Opening Too Many Accounts at Once

Each new credit application causes a “hard inquiry,” which can lower your score temporarily.

8. Use a Secured Credit Card (If Needed)

If you have bad or no credit, a secured card (with a refundable deposit) is a safe way to build credit responsibly.

9. Set Up Payment Reminders

Use apps, calendar alerts, or email reminders to avoid missing due dates.

10. Be Patient and Consistent

Improving your credit score takes time. Focus on good habits month after month and avoid shortcuts.

Common Credit Score Myths

“Checking my credit score lowers it.”

Not true—only hard inquiries affect your score.

“I need to carry a balance to build credit.”

Wrong—paying your full balance on time is the best habit.

“Closing a credit card helps my score.”

Not necessarily. Closing accounts can reduce your available credit and hurt your utilization ratio.

Final Thoughts: Take Control of Your Credit

Your credit score is not just a number—it’s a tool that can unlock opportunities or limit them. The good news? You’re in control.

With simple, consistent actions, you can improve your score, reduce stress, and make smarter financial choices. Start today—and let your credit work for you.

No responses yet